Houses on the market come in all shapes and sizes as well as conditions. Real estate investors seek out fixer-uppers because they want to flip the property. Everyday individuals may pick a house that requires several upgrades because they want to turn it into a home. Not because they want to flip it. One way to balance the cost of upgrades and the property is to obtain a favourable home loan interest rate. You can see the effects of several rates with the Best Rate Mortgage Calculator.

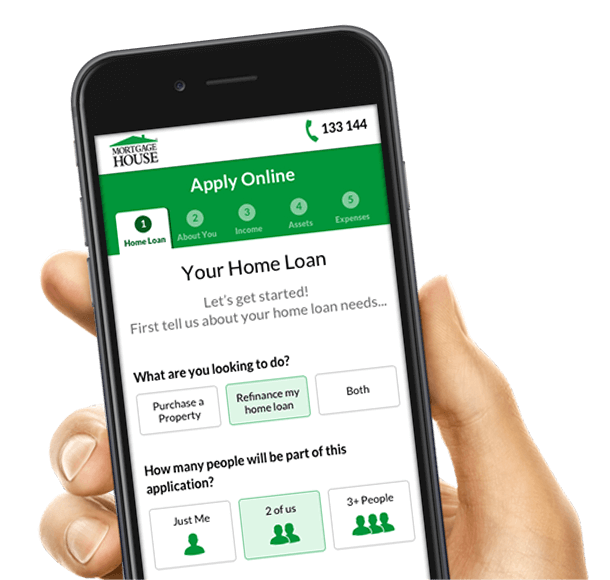

Best Rate Mortgage Calculator

The Best Rate Mortgage Calculator only has four inputs. You enter the estimated property value and loan amount. Then, pick between full documentation or low documentation. Lastly, pick a fixed interest rate or variable. The output is an array of mortgage deals with their corresponding interest rate and repayment amount. For your information, the repayment is displayed in weekly, monthly and fortnightly instalments.

These results are estimates and hypothetical scenarios because the actual home loan approved entails much more documentation and analysis.

Completing Home Upgrades

The latest features and technology advancements are integrated into the newest homes. Your home may not be old but benefits from new windows, a modern water heater and smart-home appliances. New homes often include smart thermostats, energy efficient cooling and heating systems. Older homes with solid bones can sustain the installation of these systems, too.

You may not be interested in turning your new house into a smart home. The property may still need upgrades such as a new roof, insulation and fresh coat of paint.

As you inspect the property you have your eye on, take into account how much the upgrades will cost. If the property is dilapidated, the lender may request an assessment before they agree to fund the home loan. If it passes the lender’s scrutiny, keep the property’s cost in mind. Next, aim to garner the best possible interest rate so that the cost of the mortgage is low.

The Impact of Interest Rates

A lender charges its home loan clients a fee for the funds lent in the form of interest rates. Market conditions decide quarterly interest rates. Rates are charged as a percentage based on the principal amount borrowed. Well-qualified clients tend to receive favourable rates. Market conditions can favour all borrowers, too, because sometimes, it is about having good timing.

An individual faced with the costs of several home upgrades has to balance those costs with the mortgage. Consulting with professionals like us makes the process smoother. Plus, our access to proprietary technology and information helps us help our clients.

Best Rate Mortgage Calculator Conclusion

There are a variety of home loans and interest rates on the market. Our Mortgage House Best Rate Mortgage Calculator is available to you as well as our professional opinion and expertise.