With so many different lenders and types of mortgages out there, how do you know that the one you chose is the best one for you? Here are six simple tips to help you make the right decision.

Determine How Much You Can Afford

Use an online borrowing power calculator to calculate how large a loan you can reasonably afford to pay back. We recommend buying a house that is less than your maximum amount in case of unforeseen financial hardships.

Determine How Much of a Deposit You Can Afford

Most lenders recommend a deposit of 20% to avoid paying lender’s mortgage insurance. However, saving more could help you decrease your loan term and help you save on interest repayments.

Determine Which Mortgage Term You Want

In Australia, the average mortgage term is 30 years. However, there are some 20-year options. Some lenders even have shorter loan terms for qualified individuals. Make sure whichever loan term you choose, you understand any fees associated with paying off the loan early or selling the home before the end of the loan term.

Choose the Loan With Beneficial Features

Home loans often have features attached to them, such as redraws, offset accounts, interest-only periods, lines of credit, etc. You should carefully assess your situation and find a loan that has features that match your current needs.

Decide Whether You Want a Fixed or Variable Rate

Depending on the type of home loan you choose, you could save thousands on interest rates. If you choose a variable rate, you could save more money than on a fixed rate. However, fixed rates may save you money if the interest rates increase. You may be able to switch from a fixed rate to a variable rate or vice versa. However, be aware that you may have to pay fees if you want to change from a fixed rate if you do so before the end of the fixed term.

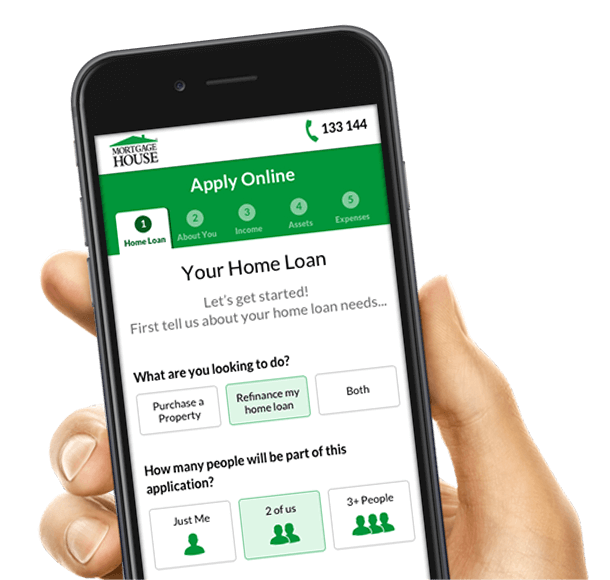

Work with a Mortgage Broker

The brokers at Mortgage House can work with you to find the best home loan for you. First, we will sit down with you and get a complete picture of your financial situation. We will then compare loans from various lenders, including interest rates and features, to help you find a rate and loan in your best interest.