Buying a house is one of the biggest and potentially a lifelong financial commitment for many Australians. There are a number of expenses that crop up when buying a house. You may be aware of the more obvious ones but don’t be caught off-guard with expenses you probably haven’t considered. We outline them below as a guide:

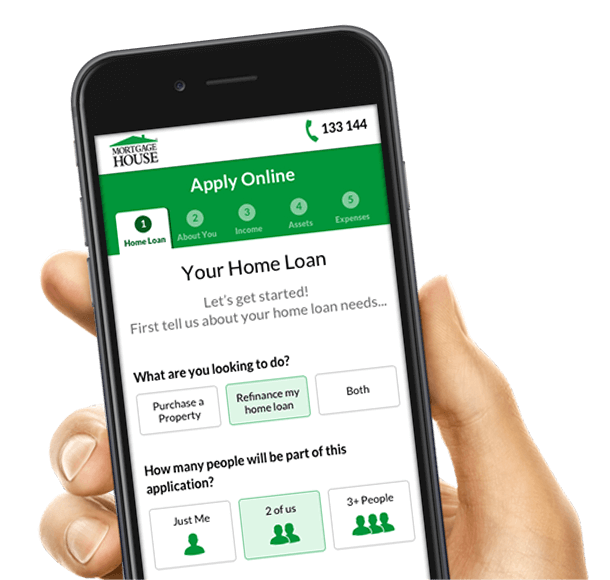

Home loan costs

When you buy a house one of the most obvious costs are the ones you make to your home loan provider both mortgage repayments and lender fees. When choosing a home loan it’s important to choose a product that best suits your needs and consider all the fees that will apply over the life of the loan.

Conveyancing Fees

Legal fees you have to pay a lawyer/conveyancer to prepare and complete all the necessary documents like the transfer of ownership and settlement. The final fee will depend on the size and complexity of the purchase. Always do your research and compare the credentials of the conveyancer and their legal fees.

Government fees

A number of government fees will apply, including land transfer registration fees and government taxes. These fees vary depending on the price of the property. You need to read the fee structures for your particular state carefully to make sure you understand all the charges that apply.

Stamp duty

Stamp duty also known as transfer of land duty is a tax you may have to pay when you buy property. The rates differ from state to state and these can add a very significant cost to the property you are buying. First homeowners may be eligible for a reduced rate of stamp duty in some states.

Mortgage protection insurance

Also called lender’s mortgage insurance or LMI, is mandatory for some loans, especially if you have less than a 20% deposit saved. LMI doesn’t protect you for any financial loss, but it does protect the lender against a home selling for less than the lender is owed.

Home and contents insurance

It could be a good idea to make sure that your new home is insured from the day of settlement (or ideally before this). This will protect your most important asset in case of an untoward emergency.

Inspection fees

There are two main forms of inspection that are recommended for peace of mind about your new home purchase:

- Building inspection – checks for structural problems

- Pest inspection – ensures the house is free of pests and termites

Moving costs

Another important set of costs to consider are moving expenses, especially if you are moving a long distance or interstate. These can be quite significant, so it’s worth shopping around. Once again there are websites that allow you to quickly and easily receive multiple moving quotes.

The costs of connecting utilities

Bear in mind other costs such as utility connection or transfer fees, which are paid to connect the water, electricity and gas. If there was no previous gas connection and you would like to now take a gas connection you’ll need to factor in these additional costs.

When buying a house the best thing you could do is make a detailed budget listing all the possible expenses you can think of. Do your research on the internet to get an idea of what to expect. Add in a buffer to cover any unexpected expenses so that come moving day you can rest assured it’s a smooth one.

Mortgage House

At Mortgage House, we’re no strangers to the homeowner’s journey. It’s a long (but rewarding) one.

But don’t worry, we can help with that.

If you’re thinking of buying a home, you can contact us for advice about the best options for you when it comes to your mortgage. The cost of your mortgage can drastically affect your financial planning, so it pays to speak to the experts about it.Use our stamp duty calculator online to learn more.