Self-Employed Home Loans — Approvals Built Around Your Business

For entrepreneurs, income proof doesn’t fit traditional boxes. As an independent lender, we assess full, alt, and low-doc scenarios directly — even recent ABNs or trust structures.

We will do our very best to find a solution that meets your expectations.

Benefits: Full/alt/low doc pathways, trust/company borrowers accepted, short trading history considered, combined business + property options.

What you’ll get out of our FREE Self-Employed Home Buyers Guide

Reduce your stress

Feel empowered on your journey to home ownership by understanding every step of the process.

Build Future wealth for you and your family

Being self-employed doesn’t mean you can’t build a successful property portfolio.

Learn the ‘home loan’ lingo

Become fluent in financial jargon so you know what counts when it matters the most.

Determine how much you can borrow

Confirm what properties you can afford to save time and money searching for your dream home.

Why Self-Employed Choose Mortgage House

Lender-First, Broker-Second

Decisions closer to the credit pen and faster clarity

Doc Pathway Choice

Full, Alt or Lo Doc aligned to your evidence and timelines

Structure-Friendly

Natural person, trust/company, and co-borrowers/guarantors considered

Short Trading History

Tailored solutions where the profile is strong (e.g., professional contractors, medical, graduates)

Powerful Combinations

Construction, land-banking, working capital and business purposes—responsibly structured

What We Accept

Full Doc

- Two years financials (company/trust where applicable), personal tax returns and NOAs

- BAS and business bank statements to show current run-rate (as needed)

- Add-backs considered (non-recurring expenses, depreciation etc., per policy)

Alt Doc

- Recent BAS and business bank statements, accountant’s letter or verified income statements

- Useful when the latest returns are not yet lodged but trading is consistent

Lo Doc

- Limited documentation with stronger equity and risk controls

- Suitable for seasoned operators with clear cash flow and asset positions

- We’ll recommend the most suitable pathway after a quick scenario call and document review.

Who we can help

- Medical practitioner leaving the hospital system to start private consulting (ABN < 24 months)

- Recent university graduate forming a professional services practice with signed contracts

- Contractor returning to a prior employer on a day-rate or fixed-term contract

- Seasonal or project-based income with strong year-to-date BAS and bank statement evidence

Structured Lending For Diverse Needs

Business-aligned funding we support (subject to policy):

- Land-banking for future projects (within risk limits)

- Working capital injection to stabilise cash flow

- ATO liabilities restructure at a lower interest rate than typical payment plans

- Business loans for plant/equipment or expansion

- SMSF loans (investment property under super law)

- Construction loans for building/major works on your future residence

Credit spectrum:

- Excellent credit: Pricing and features calibrated to high-quality conduct and equity

- Rebuilding: Responsible short-term structures designed to stabilise repayments, demonstrate conduct, and transition to sharper pricing when metrics improve

Products We Can Combine For Self-Employed Borrowers

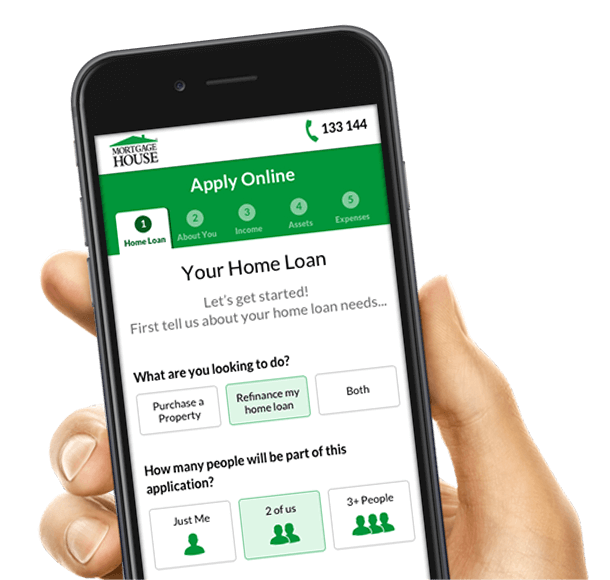

The Self-Employed Approval Process

Pre-Qualify Fast

Share your structure (sole trader/trust/company), recent BAS, bank statements and any contracts. We map Full/Alt/Lo Doc eligibility and estimate borrowing power.

Tools:

Verify & Structure

We validate income, confirm add-backs, and select features (offset, split, IO/P&I).

If building or buying before selling, we add:

Approve, Settle, Optimise

We issue a documented approval, coordinate settlement and set up offset and alerts. Post-settlement, request a rate review when LVR or performance improves.

Know More:

Real-Life Examples

Figures and approvals are scenario-specific and subject to assessment.

- Medical contractor, ABN 10 months

- Signed 12-month contract at $1,400/day, 4 days/week; BAS supports run-rate. Alt Doc with BAS + bank statements; 80% LVR purchase approved. Offset + variable split for cash-flow smoothing.

- Graduate engineer launching consultancy: Two signed client contracts ($160k pa combined), savings buffer $70k. Lo Doc at lower LVR with performance review in 12 months; plan to refinance to sharper pricing after established track record.

- Builder-owner renovating principal place: Equity release + construction progress draws; interest on drawn amounts only. Clear invoices and staged inspections; post-completion rate review drops LVR tier.

- Café owner restructuring ATO liability: Refinance + dedicated split for ATO balance, shorter amortisation for discipline. Overall repayments fall; cash flow stabilises; eligibility for sharper pricing at 6-month review.

- Tech contractor returning to prior employer: Fixed-term contract at higher salary; Full Doc not yet possible (returns in progress). Alt Doc using contract + BAS; trust borrower with director guarantees.

All You Need to Know About Self-Employed Home Loans

What are the best self employed home loans in Australia for me?

When you are self-employed, it can be difficult to provide the full financial statements or evidence of income you usually need when applying for a loan. At Mortgage House, we offer a solution to help you find a suitable mortgage. Low Doc home loans allow you to apply for a mortgage by giving you the option of self-certifying your income, without needing to provide proof of employment. While the paperwork may be less, you will still need to have a good credit history, provide tax returns and business statement. Interest rates on Low Doc Loans for self employed may be higher to compensate the lender for the increased risk. At Mortgage House we offer a large range of Low Doc loans and also have home loans for self employed under 2 years. As we say, the best loan for you is the one you can afford without creating unmanageable stress on your lifestyle. For further home loan tips read our mortgage tips checklist.

What type of Low Doc loans are available?

Mortgage House has a large range of Low Doc home loans that can be suitable for those who are self-employed. They include;

- Owner-occupier home loans. An owner-occupier home loan is a mortgage for those who are intending to live in the property they are looking to buy or build.

- Investment home loans. An investment mortgage is suitable for those investing in property, mostly residential. Investment mortgages can be suitable for either building a home to rent, or a small series of units or townhouses.

- Variable rate home loans. Variable interest rate loans are our most popular mortgages. As the name suggests, the interest rate can increase or decrease many times over the life of the loan, influenced by a range of both internal and external factors, such as the Reserve Bank’s setting of the official cash rate.

- Fixed rate home loans. Fixed rate mortgages are the main alternative to variable rate home loans. The interest rate is fixed, usually for between 1 and 5 years. Once the fixed period is over, you can renegotiate another fixed rate loan, or the mortgage will revert to a standard variable home loan.

- Toggle Offset home loans. These home loans can be a good compromise between fixed and variable. Having a toggle feature with your Low Doc home loan means the mortgage is split between variable and fixed, and you can toggle between the two at any time, to maximise your interest savings.

- Split home loans. Having a split option on your home loan can give you similar flexibility as a toggle mortgage. The main difference is there are no restrictions on the amount or portion that can be variable or fixed.

- Construction home loans. A Construction loan can help you save money if you are building a home. Instead of paying your builder everything upfront, these mortgages allow you to split the payments and only make them when agreed stages of your new home have been completed. Interest is only charged on how much you have paid out, not the full amount.

We know that close to 16% of Australians are self employed and believe that this large demographic should have access to unencumbered home ownership. Speak to us today to discuss the home loans for self employed we can offer you.

What documents do I need if I am applying for a Low Doc home loan?

Being self-employed often means you will probably not have access to the evidence of regular income from an employer. At Mortgage House, we also understand that most self-employed business owners optimise their businesses for tax efficiency and growth, not to show a bank or a lender how much income they earn. This means you may face more hurdles than other borrowers. At Mortgage House we have several home loan options for self employed and also for those self employed under 2 years, and we want to make it as easy as possible for you to find a suitable one for your property goals. Our Low Doc home loans allow you to apply for a mortgage through a “self-verification” process, which requires little paperwork. However, you will be asked to provide a few documents, to put together a cash flow statement. This statement will show a bank or lender your income and expenses. To do this, you will need:

- Your personal and business tax returns for the past two or three years

- Financial statements for your business for the past two or three years

- Proof of ability to make a deposit or down payment of 20% on most home loans.

Speak with your accountant or financial advisor if you need help providing us with this information.

If you are self-employed and your income is irregular, finding a guarantor, or someone who can give a bank or a lender a guarantee the loan will be paid, can be a good idea. We believe there is always a way to get on the pathway to home ownership, so if you are serious about a self employed home loan, we seriously want to help.

How much can I borrow if I am self-employed?

A great place to start to get an indication of how much you may be able to borrow, is Mortgage House’s borrowing calculator. Once you have an idea of your cash flow – your income and your expenses – enter it into our calculator. Also enter your partner’s income, and both your expenses, including things such as credit card and other loan repayments. From there, enter in the details of the home loan you are looking to apply for. It is important to remember that our borrowing calculator is only an indication, not a pre-approval. If the figure our borrowing calculator comes up with is below your expectations, call our expert lenders and we will work hard to help you realise your property dreams. Other helpful tools to get you on track of your spending include our popular budget planner calculator, which can fast track you into financial surplus quicker than you thought possible. More helpful tips are available in our mortgage tips checklist.

What are the benefits of a Low Doc home loan as a self employed Australian?

Low-Doc Home Loans can offer self-employed people a range of opportunities that may otherwise prove difficult to obtain. At Mortgage House, our fundamental goal is to provide an accessible service that allows as many Australians as possible to achieve their property goals and dreams. Low Doc loans are just one way we do that for those who are self-employed. Our proprietary technology allows our customers, including those who are self-employed, an easy and seamless path through the home loan process. When you choose a Low Doc self employed home loan, there are a few benefits you can take advantage of including:

- Less paperwork. When you apply for a Low Doc home loan, no matter whether it’s a variable or a fixed rate mortgage, you will require less paperwork than a regular home loan.

- Less time. The application process for a Low Doc home loan is quicker for the self-employed than a regular Full Doc Home Loan is.

- Interest rate discounts. Interest rates can be higher at the start of a Low Doc home loan if you are self-employed, as banks or lenders try to minimise their risk. However, after a period of successful repayments, interest rate discounts can apply.

How much will my repayments be on a Low Doc loan?

As a person who is self-employed, whether you are buying a home, investing in property or refinancing your existing mortgage, we can help you save money. At Mortgage House we are dedicated to putting you first, and that means giving you as much information as possible. Some banks and lenders tell their clients what they think they should know. At Mortgage House, we deliver what our customers tell us they want. And that means providing them with as much information as possible. Repayment calculators, such as the one below, allow you to know exactly how much your repayments will be if you choose certain loans.

All you need to do is enter the loan details and whether or not the interest rate is an introductory offer. You will then get a repayment figure, and you can choose weekly, fortnightly or monthly to give you an even clearer picture. You will also discover the amount of interest you will pay, and when you will pay it, over the life of your loan. All this information is important, especially if you are self-employed, or seeking a home loan for self employed under 2 years. Financial management and goal setting is easier with good budgeting and visibility of your potential home loan repayments.

How do I choose a suitable home loan?

Choosing a suitable loan can be a difficult decision, but there are a few easy questions to ask that can make things a little clearer. At Mortgage House, we can help you identify and apply for a suitable home loan for self employed, guiding you through the process from the very start to the day you settle. One way we go the extra step is by making sure your home loan is suitable, and you are not stuck with a mortgage that may not be right for you. Some of the things you need to take into consideration, as someone who is self-employed, include:

- Why do you want the loan? What do you want the mortgage for? Do you want to buy a home to live in, or do you want to invest in real estate?

- What sort of buyer are you? Are you looking to buy your first home, a subsequent home or renovate or upgrade your current one? Is your credit rating in good condition? Do you need a family member or friend’s help to secure the loan and act as a guarantor? Do you have a healthy deposit?

- Are your finances in a good condition? Try and work out how much you can afford to borrow now, all things being equal, and can you afford repayments if interest rates rise? Also, it can also be worthwhile working out what your financial goals are moving forward. Property may be a great way to increase your wealth or your credit rating if you can afford it.

We would love to get to know you and hear about your borrowing ambitions. Call us today to get the clarity you need and find out more with our online mortgage tips checklist.

What are the advantages of a fixed rate home loan if I am self-employed?

Fixed rate home loans certainly have their advantages. It can be easy to think that while interest rates are low, as they are now, that a variable rate mortgage may be a better bet. However, the longer the official cash rate remains at record lows, the closer it is to rising, and in 2022 there is evidence of this upwards climb. Whether you are self-employed or a PAYG employee, there can be lots of reasons why a fixed rate home loan can be suitable for you, including:

- Budgeting is easier. Fixed rate home loans mean you know exactly what your repayments are going to be each week, fortnight or month, as they remain consistent over the agreed period.

- Eliminate the risk of loan default. You will be shielded from variable interest rate rises.

- Make additional repayments. At Mortgage House, you can make additional repayments of up to 5% for most of our fixed home loans, without attracting a penalty. Our Progressive Fixed Home Loans allow you to make additional repayments of up to $20,000 over a year without being penalised.

- Make the most of the great features. A lot of Mortgage House fixed rate home loans include features you usually only get with a variable rate mortgage, such as offset accounts and the ability to redraw any extra repayments or lump sum payments.

What are the advantages of a variable rate home loan if I am self-employed?

Variable rate home loans are the most popular mortgages in Australia, and there are many reasons why. The flexibility they offer can be attractive, which includes things such as:

- Lower rates. A variable mortgage interest rate is generally lower than a comparable fixed rate home loan.

- Lower repayments. As a result, your repayments are likely to be lower as well.

- Extra repayments. Variable rate home loans usually allow you to make as many extra repayments as you want, without attracting any penalties.

- Most Mortgage House variable rate home loans give you access to a Redraw facility, which allows you to withdraw any extra repayments or lump sum payments you have made over the life of the loan, as long as your minimum repayments are up to date.

Get in touch with a Mortgage House lending specialist to get an idea of what your repayments may look like on a self employed variable rate loan VS a fixed rate self employed loan product.

How do I find the best interest rate on Low Doc loans?

Fill in all the details of our Best Rate Mortgage Calculator, click the Low Documentation button, and easily compare interest rates on Low Doc loans between Mortgage House home loans. From there, you can click on the home loan to find out more. If you are unsure about the breakdown of calculations, feel free to get in touch with one of our friendly Lending Specialists.

Repayment Calculator

Important Disclaimer: Repayments are indicative only and based on equal installments for the selected frequency. Fortnightly = ½ monthly; weekly = ¼ monthly. Actual repayments may vary.

Our Self Employed Loans

Comparison Rate Disclosure: The Comparison Rate for each home-loan product shown is based on a $150,000 loan over 25 years. Fees and charges may apply. Warning: The Comparison Rate is true only for the examples given and may not include all fees and charges. Different terms, fees or amounts could produce a different comparison rate.

Borrowing Power Calculator

Your Monthly Repayment

.

You Can Borrow Up To

.

Important Disclaimer: This is intended as a guide only. Details of terms and conditions, interest rates, fees and charges are available upon application. Mortgage House’s prevailing credit criteria apply. We recommend you seek independent legal and financial advice before proceeding with any loan. WARNING: * This mortgage calculator shows indicative repayments based on 12/26/52 equal repayments for monthly/fortnightly/weekly options.

Key Home Loan Features of Mortgage House

Attractive interest rates

Our mortgages are tailored to either owner-occupiers or investors, meaning we can offer interest rates that are bespoke to their needs. As Australia’s leading non-bank lender, we are big enough to give you market-leading interest rates and small enough to care.

Offset facility

Use a non-interest-bearing bank account to offset the interest on your mortgage. Interest is calculated on the difference between the two accounts, rather than just the mortgage account. This can save you money.

Additional repayments

Make extra repayments or lump sum payments whenever you want, without being penalised or charged fees.

Redraw

Withdraw those extra repayments when you need them, as long as your minimum repayments are up to date.

Can I be approved with less than two years’ ABN?

Often, yes—particularly for professionals with current contracts and strong BAS/bank evidence. We’ll guide you to the right doc pathway.

What if my latest returns are not lodged yet?

Alt Doc can bridge timing gaps with BAS and bank statements or an accountant’s letter, subject to policy.

Do you lend to trusts/companies?

Yes—trust/company borrowers considered with guarantees as required.

Can I combine construction with self-employed income?

Yes—progress draws with interest on amounts drawn; we verify scope and builder credentials.

Can you help with ATO liabilities?

Yes—where suitable, we may consolidate into a lower-rate split with a disciplined term.

Disclaimer: All lending is subject to responsible lending obligations, full assessment and verification. Acceptance, pricing and features (including Alt/Lo Doc, construction, cash-out, ATO restructure, business purposes and trust borrowing) are subject to valuation, LVR and Underwriting Credit Policy at the time of decision. This is general information only — seek licensed tax, legal and financial advice.