Mortgage Repayment Calculator

Estimate Your Repayments

Simple To Understand

Variable Options

Quick & Easy

Save Money With The Switching Mortgage Calculator

Switching mortgages can be daunting but with all the options right in front of you, Mortgage House has made it easy. Mortgage House can help you understand your financial situation and what is achievable for you. This makes switching your mortgage a simple and cost-effective process.

Oodles of Options

Assessing the different lender choices available can help you find the best deal possible for your situation.

Understand The Facts

Switching your mortgage can pose switching fees. We’ve made it simple to understand what you’re up for.

Accurate

With all the options in front of you in real time, picking out the best deal for your refinancing is easy.

Save Money

The best part about refinancing or switching your mortgage is the fact that you can lower your monthly repayments.

Repayment Calculator

Important Disclaimer: This is intended as a guide only. Details of terms and conditions, interest rates, fees and charges are available upon application. Mortgage House’s prevailing credit criteria apply. Please note that your actual fortnightly repayment would be equal to the monthly repayment amount divided by two. Weekly repayments would equal the monthly repayment amount divided by four. If you choose to pay fortnightly or weekly, your actual repayments will be higher than repayments shown on this page. You can reduce the term of your loan if you choose to make repayments fortnightly or weekly. We recommend you seek independent legal and financial advice before proceeding with any loan.

Our All Loans

Repayment Calculator

Important Disclaimer: This is intended as a guide only. Details of terms and conditions, interest rates, fees and charges are available upon application. Mortgage House’s prevailing credit criteria apply. Please note that your actual fortnightly repayment would be equal to the monthly repayment amount divided by two. Weekly repayments would equal the monthly repayment amount divided by four. If you choose to pay fortnightly or weekly, your actual repayments will be higher than repayments shown on this page. You can reduce the term of your loan if you choose to make repayments fortnightly or weekly. We recommend you seek independent legal and financial advice before proceeding with any loan.

What Do Your Principal and Interest Repayments Look like?

Your Monthly Repayment

.

You Can Borrow Up To

.

Important Disclaimer: This is intended as a guide only. Details of terms and conditions, interest rates, fees and charges are available upon application. Mortgage House’s prevailing credit criteria apply. We recommend you seek independent legal and financial advice before proceeding with any loan. The Comparison Rate for each of the home loan products contained in this page is based on a loan of $150,000 over a 25 year term. Fees and charges may be payable.

WARNING: The comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. * This mortgage calculator shows indicative repayments based on 12/26/52 equal repayments for monthly/fortnightly/weekly options.

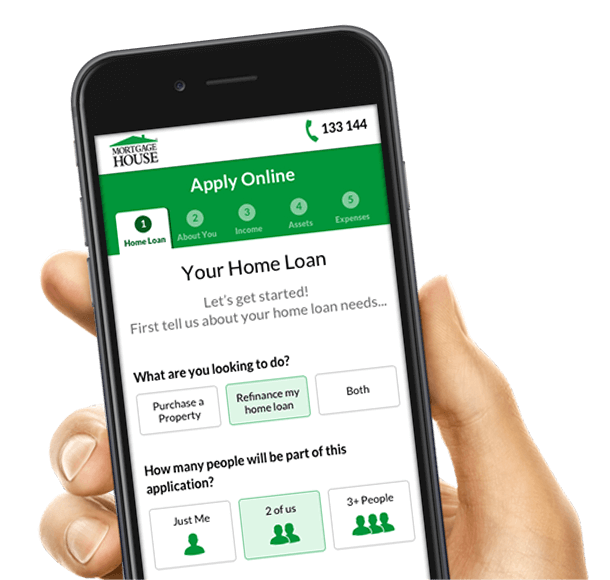

Your Home Loan Journey Starts Here

Check your borrowing power

Your options begin by first understanding the amount of money you can borrow. Once you know this, you know what areas and homes are in your price range.

What type of loan works for you?

With tailored options to suit everyone, choosing the loan that is appropriate to you with Mortgage House is easy!

Understand your repayments

By using the Mortgage Repayment Calculator, you can assess your budget and how much your mortgage will cost you on a weekly, fortnightly or monthly basis.

Start browsing houses

The most exciting part of your journey is knowing what you can purchase so you can begin looking!

Want to Know More About Mortgage Repayments?

What is repayment on a mortgage?

Repayment simply means paying back a certain amount of money you have borrowed. Everyone’s mortgage is different and therefore everyone’s mortgage repayment formula is independent of their loan. Your mortgage repayments are calculated by the type of loan you have (fixed or variable), amount of purchase price and your choice of monthly, fortnightly or weekly payments. Understand what the benefits of each repayment frequency option are here.

How are loan repayments calculated?

Factoring in a multitude of different variables, loan repayments vary from mortgage to mortgage. The type of loan you have (fixed or variable), amount of purchase price and your choice of monthly, fortnightly or weekly payments are all factors that are taken into consideration when calculating your repayments. Using a repayments calculator to calculate loan repayments is the best way to understand your repayments. Learn more about repayment calculations here.

What's the difference between interest-only and repayment mortgage?

Significantly smaller in repayment size, an interest-only mortgage requires you to only pay back the interest on your loan. A repayment mortgage includes your interest and the initial sum borrowed. There are perks of both but depending on your financial situation will depend on which one you opt for.

An interest-only loan still requires you to pay off your total mortgage at the end of the mortgage term whereas the repayment mortgage chips away at it within the repayments. Checking your repayment options with a home loan repayments calculator is the best place to start to estimate how much your repayments will be.

What is the difference between payment and repayment?

Both are nouns and require you to pay a certain amount of money. A repayment is paying back money that you have borrowed or loaned, whereas a payment is simply the act of paying for something. The repayment means you already have the product or service and a payment is paying for that product or service.

How can I find out what my home loan repayments will be?

Everyone’s mortgage and repayments are different. The best place to understand your home loan repayments will be by using a calculator. Using this calculator can tailor your repayments using payment frequency, loan type and amount borrowed. Heavily based on the frequency you choose, you can understand the benefits of using fortnightly repayments here.

How do you calculate mortgage repayments?

Calculated using a formula of loan amount, loan type, length of loan and amount borrowed, your mortgage repayments are unique to you and your purchase property. Using a mortgage repayment calculator can help you understand how much you will pay, when and how. Repayment options are endless and the benefits of weekly repayments are evident.

How are monthly repayments calculated?

Mortgage repayments are calculated through a formula of frequency, loan type, length and amount. Using a repayment mortgage calculator can assist you in understanding how much your home loan repaymentswill be. Your income plays a huge role in how your repayments are calculated. For more of an idea of how much your income can affect your mortgage repayments, this article offers insight.

What is the formula for calculating a 30-year mortgage?

Using the toggles and inputs in our calculator, you can change the loan period, interest rate, loan type and loan amount to help you calculate loan repayments. This calculator helps you to gauge your principal and interest repayments; whether that be for 10 years or 30. Don’t be shocked, there are a few ways to lower your mortgage if it seems too much, including investment property options or increasing the length period of your loan.

How do I calculate mortgage repayments in Excel?

Do you have a microsoft account? If yes, using PMT you can calculate the monthly payment of your mortgage. This can be done by inputting the period of loan, interest rate and current home value (loan amount). This can be confusing and can also cause you to forget some things. Our Calculator creates the options for you! Input your variables to assess your repayments with Mortgage House today!

What customers say

Before using Mortgage House, we tried another broker who made us feel like we weren't important enough for him to bother dealing with properly, and we always felt like we weren't getting the whole story. Jenny from Mortgage House was completely different. From the very beginning she kept us in the loop of everything that was happening, and always made sure she got back to us in a timely manner. Being completely new to this whole process she answered all questions we had and never made us feel like we were asking a dumb question. I don't think we would have been able to buy our first property without Jenny or Mortgage House. Thanks for everything!

Cannot recommend Michael Richardson from the Sutherland branch enough - he assisted us through the transition of refinancing a mortgage every step of the way. He was always available to talk through the options & guided us wherever he could with the documentation requirements. He visited our house after hours to accommodate us getting through what would normally have been an onerous task for 2 busy working parents trying to save some money on their home loan.

I refinanced and the process couldn't have gone more smoothly, great communication throughout the process made it stress free. All staff very professional and made jargon easy to understand. Not to mention a great highly competitive variable rate that the other lenders couldn't match. Have already highly recommended to friends.

Mortgage House were very helpful. I was extremely nervous about the process of refinancing however, Brij, my consultant made everything easy for me and was really supportive throughout the whole process. The process was also very quick. I would highly recommend Mortgage House.

Benefits of Being a Mortgage House Customer

- Quick and easy application process with less paperwork needed

- Unlimited and free redraws of additional repayments

- Variable and Fixed Rates with no penalties on fixed rate loans

- Innovative online services designed to assist you