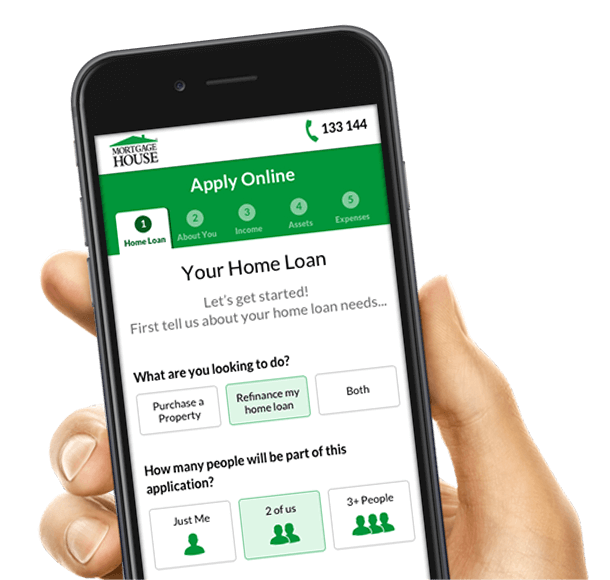

Alt Doc Home Loans for Self-Employed Australians

Being self-employed means freedom — but it also means your paperwork doesn’t always move at the same pace as your business. If you’re a contractor, sole trader or business owner with strong income but incomplete financials, an Alt Doc Home Loan offers a practical pathway to get moving sooner.

Alt Doc (short for Alternative Documentation) simply means we assess your income using BAS, bank statements, accountant letters or contract evidence instead of waiting for full tax returns.

Mortgage House has been helping self-employed Australians for almost four decades. We understand the ups, downs and deadlines of running a business — and we’re ready to help during and outside standard business hours.

What Is an Alt Doc Home Loan?

An Alt Doc Home Loan allows you to verify income using alternative forms of evidence instead of completed tax returns or full financial statements.

It is ideal when:

- Your accountant is still lodging your returns

- Your BAS or bank statements show a clearer picture of income

- You have reliable contract income

- You have solid trading history but incomplete paperwork

- You are too time-pressured to gather full documentation

Alt Doc sits between Full Doc and Low Doc — offering more flexibility than Full Doc and lower pricing than Low Doc, because documentation still exists, just in a different format.

Common Alt Doc Income Evidence

Business Activity Statements (BAS)

Shows turnover, GST position and trading consistency.

Business Bank Statements

Typically 3–12 months. Demonstrates real cash inflows from your business activities.

Contracts or Letters From Employers / Principal Contractors

Ideal for professional contractors, tradies, IT consultants, health professionals and project-based workers.

Accountant’s Letter

A formal income declaration from your accountant based on trading patterns and available information.

Borrowers often provide a combination of the above.

Who Is an Alt Doc Loan Best Suited For?

If your financials are out of date — or you simply don’t have time to assemble everything — Alt Doc may be the fastest and most practical solution.

Alt Doc pathways are designed for:

- Self-employed professionals

- SME business owners

- Sole traders and independent contractors

- Time-poor operators running busy businesses

- Borrowers with unlodged tax returns

- Borrowers using trusts or company structures

- Operators recovering from business pivots or expansions

Why Self-Employed Borrowers Choose Mortgage House

We take time to understand the story behind your numbers

— not just the numbers themselves.

Repayment Calculator

Important Disclaimer: This is intended as a guide only. Details of terms and conditions, interest rates, fees and charges are available upon application. Mortgage House’s prevailing credit criteria apply. Please note that your actual fortnightly repayment would be equal to the monthly repayment amount divided by two. Weekly repayments would equal the monthly repayment amount divided by four. If you choose to pay fortnightly or weekly, your actual repayments will be higher than repayments shown on this page. You can reduce the term of your loan if you choose to make repayments fortnightly or weekly. We recommend you seek independent legal and financial advice before proceeding with any loan.

FAQs

Is Pricing Higher for Alt Doc Home Loans?

Alt Doc loans generally price lower than traditional Low Doc loans due to stronger documentation quality.

Pricing varies depending on:

- Loan-to-value ratio

- Strength of income verification

- Loan purpose

- Credit history

- Property type

Mortgage House provides transparent assessment so you know exactly what is achievable.

Alt Doc vs Low Doc – What’s the Key Difference?

Alt Doc

- Uses structured alternative documentation

- Often lower pricing

- For borrowers with evidence, just not in standard formats

Low Doc

- Minimal documentation

- Higher risk = usually higher pricing

- Suitable where income verification is limited

Can I Get an Alt Doc Loan With Less Than Two Years’ ABN?

Possibly.

Strong income profiles — such as transitioning from PAYG to contracting — may be eligible depending on industry, experience and income history.

Can I Use Alt Doc for Construction Loans?

Yes.

Construction loans may be available where income reliability can be demonstrated using BAS, bank statements or accountant confirmation.

Can You Assist With ATO Liabilities or Working Capital?

Yes.

Refinancing solutions may allow you to:

- Clear ATO debt

- Consolidate business liabilities

- Access working capital

- Smooth cash flow fluctuations

Responsible lending obligations apply.

Compliance Note: All lending is subject to responsible lending obligations, full assessment and verification. Acceptance, pricing and features (including Alt/Lo Doc, construction, cash-out, ATO restructure, business purposes and trust borrowing) are subject to valuation, LVR and Underwriting Credit Policy at the time of decision. This is general information only—seek licensed tax, legal and financial advice.

Speak With a Lending Specialist

Our specialist team helps self-employed borrowers during and outside standard business hours.

Enquire online or request a callback at a time that suits you.