Join The Mortgage House Branch Network

Become an integral part of making Australian property ownership dreams come true with the backing of a leading national brand. Discover how managing your own Mortgage House Branch will reward you now and into your bright future.

Your Success Story Begins Here

Benefit from the guidance of a highly experienced management team as you build your own Mortgage House Branch business.

Whether you have recently acquired your Certificate IV in Finance and Mortgage Broking or are ready to be your own boss in the finance lending industry, we welcome you to express your interest in joining our award-winning national network.

25,000 – Customers with current loans

250,000 – Customers on our marketing database

$5,000,000,000 – Funds under management

Make it Happen in 3 Easy Steps

Express Your Interest

Pre-register your interest by filling in your details. A Branch Success Specialist will get back to you with further information.

Complete Application Forms

Help us get to know you by providing relevant details about your experience and qualifications.

Launch Into Lending

Begin offering your customers award-winning loan products, faster approvals, and 5-star service.

Fast-track the accreditation process by filling in your details.

Become an authorised credit representative of Mortgage House. Complete the form below to streamline the process of building your own business in finance and lending with Mortgage House today.

Why Choose to Become a Mortgage House Branch

Direct, ongoing access to highly experienced management heads

Smooth start-up process to set you up for success

Regular communication and relationship building within the network

Business success tips and advice

Media and digital marketing strategies to advantage individual branch businesses

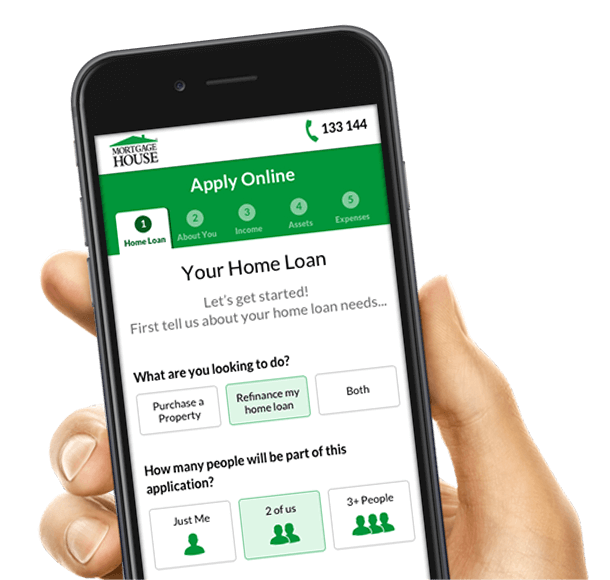

Online application process for faster processing and maximum efficiency

Inbuilt technologies including credit history search and valuation requests

Specialised, state-of-the-art lead generation software

Impress your customer-base with flexible, award-winning loan products

Realistic qualifying criteria and calculation tools

Tailored solutions for every type of borrower, including debt consolidation and SMSF loans

Tools and resources at your fingertips to deliver quick, positive outcomes

Your Success is our Success

Mortgage House puts branches first with a focus on serviceability and clever borrowing capacities. We have done all the heavy lifting by creating super-streamlined systems. This means that you can focus on satisfying new customers and building positive relationships as you grow your Branch within our network.

- Enjoy helping more Australian borrowers achieve their home ownership dreams

- Reap the rewards of unlimited earning potential

- Feel satisfied with career freedom and lifestyle flexibility

Learn More About Becoming a Branch

Open a world of opportunity

Download our ‘Branch Partnership Brochure’ and discover the many benefits of aligning yourself with the reputable Mortgage House brand.

Loans for Every Type of Borrower

There is nothing more rewarding than helping your customers achieve their financial goals with competitive loan solutions.

Benefits for you:

Leverage our first home buyer solutions to move more customers from application to approval.

- Faster combo applications for family pledge loans, giving you access to two customers at once

- Process more loans, with the confidence that you’ll always find a solution for your customers

- Provide smarter options with pre-tax income considerations

Benefits for your customer:

Our loan features are designed to help first home buyers own their property sooner.

- Family pledge – smart loan options

- Low deposit options available to your customer to own their home sooner

- Pre-tax income considerations for clever buying capacities

Benefits for you:

Make your workload lighter when dealing with experienced customers.

- Faster approvals with competitive prime loans

- Let your experienced customer do the work for you – they can apply online and upload documents through our system

- A holistic case-by-case assessment will provide the best loan option for your customers

Benefits for your customer:

We can help second home buyers own their property sooner with low rates, online tools, and flexible options.

- Award-winning super-low rates with faster approvals for experienced borrowers

- Innovative online application to help make owning a second home a smooth process

- Our flexible loan products will help your customers get the right solution for their needs

Benefits for you:

Increase your investor customer base with our smart loan solutions.

- Clever solutions for investment gearing

- Help your customers increase their investment portfolio

- Offer your customers greater borrowing capacity

Benefits for your customer:

Our special features can help your customers achieve their goals of property investment.

- Greater rental considerations for increased serviceability

- Portfolio-friendly considerations

- Larger borrowing capacity for multiple properties

Benefits for you:

Get the competitive edge and process refinancer loans with confidence

- Impress your customers with competitive new loan offerings

- Provide solutions for your customers’ changing circumstances

- Competitive refinance solutions for all loan purposes

Benefits for your customer:

We can help your refinancer customers get a better deal.

- Competitive rates for new customers to challenge their existing funder

- Dollar-for-dollar refinance available, even with high LVR considerations

- Also available for multiple loan purposes, including investment, personal, and car loans

Benefits for you:

Unlock a traditionally difficult customer base with our loan solutions.

- Gain new customers by servicing those looking to build multiple dwellings

- We keep you in the loop at each stage of the construction, so that you can deliver exceptional customer service

- Get your customer the funding they need for their new property faster

Benefits for your customer:

We can help your customers build their property with our innovative tools and solutions.

- Multiple dwellings per title available

- Draw-down payments will help protect customers from being taken advantage of

- Greater borrowing capacity for single-dwelling titles

Benefits for you:

We’ll help you make smaller transactions work in your favour.

- Support your customer’s dreams by providing competitive rates, even when the customer is only looking to renovate

- Provide renovation solutions with flexible property size considerations

- Offer smart repayment solutions for your customers

Benefits for your customer:

Our solutions can help your customers move on to the next phase of renovation and development.

- Bespoke LVR considerations when refinancing for renovation purposes

- Smaller property size considerations are available

- Offset accounts available so your customer can offset funds they have not yet used for renovation purposes towards interest payable

Benefits for you:

Provide a flexible solution for your customers sooner, saving you time and effort.

- Provide unique solutions for your customer’s individual circumstances

- Offer greater borrowing capacity for savvy investors

- Faster turnarounds when the customer does the work for you

Benefits for your customer:

Packed with smart features, our renovation loans are designed for customers on the move.

- Deferred interest payable solutions are available

- Greater borrowing capacity for customers with investment properties or lower LVRs

- Streamlined access to funding via online applications

Benefits for you:

Access this growing market with minimal effort.

- Prime loan considerations for experienced business owners

- Provide clever tax-efficient considerations for greater borrowing capacity

- Provide solutions on a case-by-case assessment

Benefits for your customer:

Our loan solutions can help your self-employed customers own their property sooner.

- Very competitive rates with greater borrowing capacity

- Unique business expenses could be considered as non-taxable income

- Flexible considerations for those with a lower credit score

Benefits for you:

Offer more options to your investor customer base with SMSF loan solutions.

- Be one of Australia’s only SMSF home loan lenders

- Help your customers build future wealth

- Extend the lifespan of your customer relationships

Benefits for your customer:

The option of SMSF lending will open a world of investment possibilities.

- Superannuation portfolio diversification

- Smart retirement planning

- Best advice and loan solutions for SMSF property investment

Recent Awards

Year on year, we deliver 5-star service and industry-leading loan products.

National awards and media recognition highlight our dedication to excellence.

Mortgage House wins 2023 ProductReview financial services award for the second year in a row and third time overall.

ProductReview is an independent assessment of services as rated by the ProductReview community. Companies are evaluated based on parameters such as customer service, honesty and openness, timeliness, and efficacy of online tools.

“More than ever, Australians want and deserve excellent service from their lender and an easy, transparent application process. With this award, existing and future customers know they can expect 5-star treatment,” says Mortgage House general manager Sean Bombell. Mortgage House was founded over 35 years ago with a mission to offer a level of customer service and diversity of products previously unheard of in the loan and mortgage finance market.

Tailored Loan Solutions for Your Customers

As a Mortgage Street Broker you will have multiple loan series at your fingertips for case-by-case lending flexibility.

Series

Competitive solutions for premium and specialty customers with faster approvals.

Competitive rates and even faster approvals

Clever policy considerations and flexible solutions

Niche solutions for speciality loans

Series

Premium customers enjoy access to our Advantage Series: low-rate loans with no fuss.

Super-low rates with large borrowing capacity

Loans available for every type of purpose

Streamlined documentation across product offering

Series

Specialising in unique cases, the Blue Series gives you the ability to deliver the best possible solutions.

Greater flexibility for niche solutions

Tax-efficient considerations for borrowing requirements

Loan size considerations for those special cases