Debt Consolidation

Struggling to keep up with multiple debts like credit cards, car or personal loans? Then it might be worth considering debt consolidation.

Enjoy a super-low interest rate

Get access to interest-saving features

Unlock secrets to successful home buying comprehensive guide.

Pay fewer fees

On Your Way To Debt Consolidation

Gather your current debt details

Spend an hour or two going through your paperwork, emails and accounting to compile a list of your current loans including credit cards, personal loans, car loans, student loans etc. Note down each loan’s interest rate, balance and monthly fees.

Schedule a call with a Lending Specialist from Mortgage House

Once you have your current debt information on hand, arrange a time to speak to one of our experts. The simple act of unloading your financial burdens onto someone who can help you is very liberating. You will be presented with various debt consolidation loan options with lowest interest rates to suit your situation.

Choose the best debt consolidation loan option

Go through the options presented to you. Do your math and bear in mind the recommendations given to you by our Lending Specialists. When you are ready, proceed with your optimal debt consolidation product with the help of our customer service professionals.

Benefits of Debt Consolidation

Enjoy a super-low interest rate:

By refinancing your home loan to consolidate your debt, you can take advantage of our super-low rate home loans, rather than paying the high interest rates of a credit card and save big.

Get access to interest-saving features:

When you add your other debts to your home loan, you can make the most of a home loan’s interest-saving features, such as a redraw facility or offset account.

Pay fewer

fees:

Every lender has their own set of fees and charges to cover things like administration and transactions. If you have multiple debts, you’ll be paying these costs numerous times. With a debt consolidation loan, you’ll only pay one fee.

Be stress

free:

Having one loan means you can forget about the stress of tracking multiple repayments. You’ll only need to deal with one lender and one set of conditions and fees.

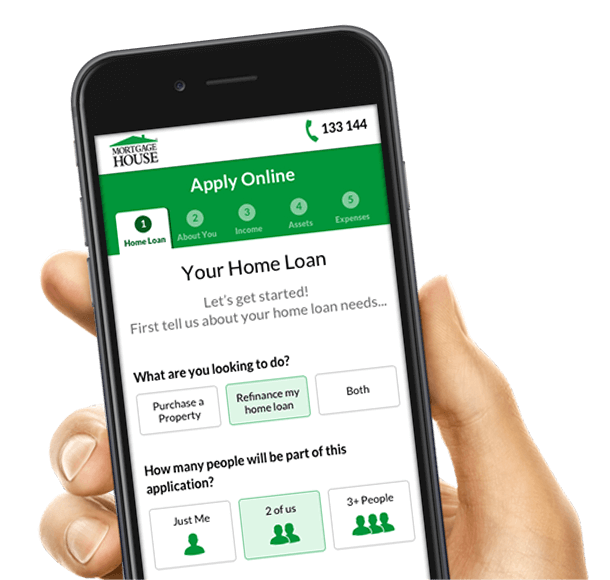

Apply Online Anywhere, Anytime.

Things you Should Know

How can Mortgage House help me out of debt and improve my credit score?

Find out how easy it is to get back on track and manage your debt. Apply online by clicking the button below to begin! Our expert Lending Specialists will find the best solution for you. Whether this means a personal debt consolidation loan or using your current low rate home loan to consolidate other debts into, you may be surprised with how quickly you can eliminate financial stress and get ahead. Find more information in our mortgage tips checklist.

Are there more benefits for debt consolidation?

Enjoy a super-low interest rate:

By refinancing your home loan to consolidate your debt, you can take advantage of our super-low rate home loans, instead of paying the high interest rates of a credit card. As a result of a lower interest rate, consolidating your debt can bring about long-term savings.

Get access to interest-saving features:

When you add your other debts to your home loan, you can make the most of a home loan’s interest-saving features, such as a redraw facility or offset account.

Pay fewer fees:

Every lender has their own set of fees and charges to cover things like administration and transactions. If you have multiple debts, you’ll be paying these costs numerous times. By consolidating your debt into one loan, you’ll only pay one fee, saving you plenty across the life of your loan.

Be financially stress-free:

Having one loan means you can forget about the stress of tracking multiple repayments. You’ll only need to deal with one lender and one set of conditions and fees. With friendly customer service, Mortgage House aims for 5-star dealings.

Better your credit rating:

By using BPAY, you don’t ever need to miss a payment, meaning you can rebuild and improve your credit rating over time.

Easily budget and plan your finances:

When you only need to account for one repayment, it is much easier to budget. It also allows you to create clear financial plans so you can work towards being debt-free by a specific date.

Pay more of your principal debt:

Maintain the same monthly repayment as your combined loans, but by consolidating your debt to a lower interest rate home loan, you’ll be paying more of the principal, thus paying off your debt faster.

What is Debt Consolidation?

Being in debt isn’t always a bad position. Debt only becomes a problem when it’s unmanageable, and you struggle to keep up with multiple repayments from banks or lenders. In this case, consolidating your debt can be beneficial.

Consolidating your debt allows you to combine multiple smaller debts, like a credit card, personal, car or student debt, into one easy-to-manage repayment per month.

Debt consolidation is a convenient process that can help you stay on track and in control of your finances. Some people may choose to take out a personal debt consolidation loan. If you have a home loan, it is often the best decision to combine your other debt into your home loan to take advantage of super-low home loan rates and money-saving features. Feel free to get in touch with our experienced Lending Specialists for personalised assistance. For more online debt consolidation tips read our mortgage tips checklist.